ETF Explained

What is an ETF?

Exchange-Traded Funds, better known as ETFs, have become one of the fastest-growing investment vehicles in the world. Whether you are a complete beginner in trading, an intermediate investor expanding your portfolio, or an advanced trader looking to optimize strategies, ETFs provide opportunities across every skill level.

An ETF is an investment fund that trades on stock exchanges, just like a regular stock. It holds a collection of assets—such as stocks, bonds, commodities, or currencies—and allows investors to buy shares that represent ownership of that basket. Instead of buying dozens of individual companies to diversify, an investor can purchase one ETF and instantly gain exposure to a wide range of assets.

Since their creation in the early 1990s, ETFs have exploded in popularity. Today, they manage trillions of dollars worldwide and are used by retail investors, institutional funds, and hedge funds alike.

This guide will break down ETFs for all levels of traders—from basic concepts to advanced strategies—so you can understand their role in financial markets and decide how to use them effectively.

What Makes an ETF Different?

At its core, an ETF is like a basket of investments. For example:

- A stock ETF might include shares of Apple, Microsoft, Google, and dozens of other tech companies.

- A bond ETF might include U.S. Treasury bonds, corporate bonds, or global debt instruments.

- A commodity ETF might give you exposure to gold, oil, or agricultural products.

Instead of purchasing each asset individually, you buy one share of the ETF and automatically own a fraction of all those underlying assets.

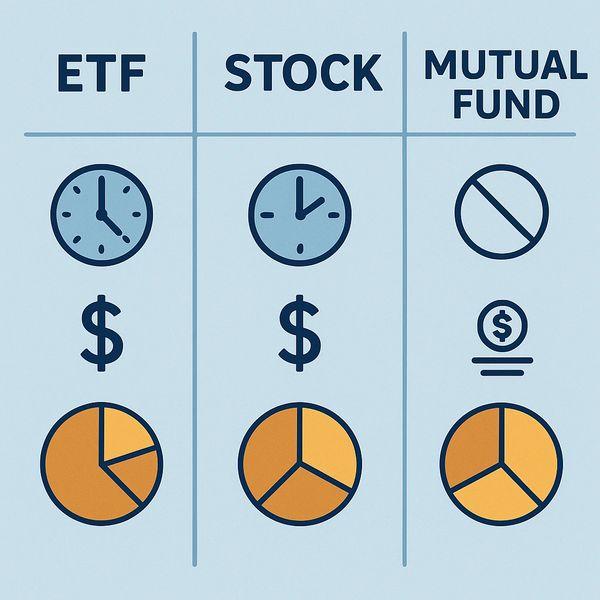

ETFs vs. Mutual Funds

For many beginners, ETFs sound similar to mutual funds. The main differences are:

- Trading Style: Mutual funds are priced once a day (after the market closes), while ETFs trade on exchanges in real-time—just like stocks.

- Costs: ETFs often have lower management fees compared to mutual funds.

- Accessibility: You can buy as little as one share of an ETF, making them very beginner-friendly.

Key Benefits of ETFs for Beginners

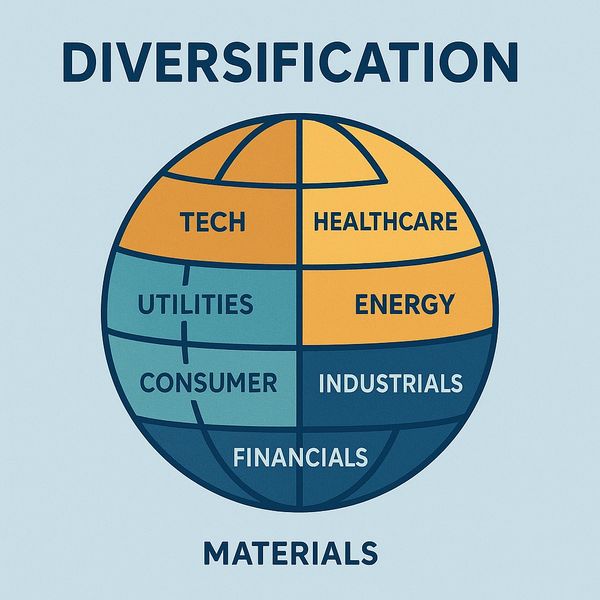

- Diversification: With one purchase, you own exposure to multiple assets.

- Affordability: ETFs usually have lower fees than actively managed funds.

- Flexibility: They can be traded throughout the day at market prices.

- Transparency: Most ETFs disclose their holdings daily.

Risks Beginners Should Know

- Market Risk: If the market sector or asset an ETF tracks goes down, so will the ETF.

- Liquidity: Some ETFs trade with low volume, making it harder to enter or exit at the desired price.

- Tracking Error: Occasionally, an ETF may not perfectly follow its underlying index or assets.

Example for Beginners:

Imagine you believe the U.S. stock market will grow over the next 10 years. Instead of buying 500 individual companies in the S&P 500 index, you could simply buy an ETF that tracks the S&P 500—giving you instant exposure to all of them.

As traders gain experience, they start exploring

Types of ETFs

- Equity ETFs: Track a stock index or sector (e.g., technology, healthcare).

- Bond ETFs: Provide access to government or corporate bonds.

- Commodity ETFs: Track assets like gold, oil, or agricultural products.

- Currency ETFs: Give exposure to foreign currencies (useful for forex traders).

- Thematic ETFs: Focus on specific trends such as artificial intelligence, clean energy, or emerging markets.

- Inverse ETFs: Designed to profit when markets decline.

- Leveraged ETFs: Amplify daily returns (e.g., 2x or 3x performance of an index).

How ETFs Are Structured

Most ETFs are index-based, passively tracking a market benchmark. However, some are actively managed, meaning professional managers select assets within the fund.

Key elements intermediates should study:

- Expense Ratios: Annual fees charged by the ETF provider.

- Liquidity and Trading Volume: More liquid ETFs usually have tighter bid-ask spreads, making them cheaper to trade.

- Tracking Accuracy: How well the ETF mirrors its benchmark index.

- Tax Efficiency: ETFs are generally tax-efficient, but rules vary by country.

Evaluating an ETF

Intermediate traders should consider:

- The fund’s underlying assets (what does it actually hold?).

- Geographic exposure (U.S., Europe, Asia, or global?).

- Sector exposure (technology, finance, healthcare, etc.).

- Risk profile (is it stable like bonds, or volatile like leveraged ETFs?).

Example for Intermediates:

If you are bullish on renewable energy, instead of buying one solar company, you could purchase a Clean Energy ETF. This spreads your risk across dozens of companies in that sector.

Advanced investors use ETFs in more complex strategies

Leveraged and Inverse ETFs

- Leveraged ETFs: Multiply the daily return of an index (e.g., 3x S&P 500 ETF). These are powerful tools but can magnify both gains and losses.

- Inverse ETFs: Move in the opposite direction of the index. For example, if the S&P 500 drops 2%, an inverse ETF might rise 2%.

Arbitrage Opportunities

ETFs are structured to stay close to the value of their underlying assets, but small discrepancies can occur. Advanced traders sometimes exploit these differences through arbitrage strategies.

ETFs in Forex and Global Markets

Currency ETFs allow traders to speculate or hedge against currency movements without directly trading forex pairs. For example, a U.S. investor can buy a euro ETF instead of holding EUR/USD in the forex market.

Advanced Portfolio Applications

- Hedging: Investors can hedge long equity positions with inverse ETFs.

- Sector Rotation: Traders can shift between ETFs representing different sectors depending on market cycles.

- Options on ETFs: Many ETFs also have listed options, adding another layer of strategies such as covered calls or protective puts.

Example for Advanced Traders:

A hedge fund manager might be heavily invested in U.S. technology stocks. To protect against a market downturn, they could buy an inverse NASDAQ ETF, offsetting potential losses.

ETF Trading Strategies Across Levels

Long-Term Investing (Beginner-Friendly):

Buy and hold broad market ETFs (like S&P 500 ETFs) for steady growth.

Swing Trading (Intermediate):

Trade sector ETFs based on technical patterns and short-term momentum.

Hedging (Advanced):

Use inverse ETFs to balance long exposure in volatile times.

Diversification (All Levels):

Spread risk across multiple asset classes by holding different types of ETFs.

ETFs vs Other Investment Vehicles

- ETFs vs Stocks: ETFs diversify risk by holding many stocks, while individual stocks carry company-specific risks.

- ETFs vs Mutual Funds: ETFs are cheaper and more flexible but lack professional active management in most cases.

- ETFs vs CFDs (Contracts for Difference): CFDs are leveraged instruments for speculation, while ETFs are generally longer-term, lower-risk investments.

- ETFs vs Futures: Futures require margin and rollovers; ETFs are simpler and accessible to all traders.

Conclusion: Why ETFs Matter in Modern Trading

ETFs have revolutionized the investment landscape by combining the diversification of mutual funds with the flexibility of stocks. Beginners appreciate their simplicity and affordability, intermediates benefit from specialized sector or thematic exposure, and advanced traders can use leveraged, inverse, and currency ETFs for sophisticated strategies.

No matter what stage of trading you are in, ETFs can play a role in your financial journey. The key is understanding what you are buying, evaluating risks versus rewards, and using ETFs as part of a broader trading or investing plan.

As global markets evolve, ETFs will remain a central tool for traders and investors worldwide. They provide accessibility, transparency, and opportunity—whether you’re building wealth slowly, managing a portfolio, or executing advanced strategies.